50-30-20 budget rule of personal finance, 50-30-20 Rule for Budgeting, Creating Your 50-30-20 Budget, Building a 50-30-20 budget

Budgeting can often feel like a daunting task, especially when your financial situation seems complex and overwhelming. That’s where the 50-30-20 rule comes in – a straightforward and effective budgeting technique that can help you take control of your finances with ease. In this article, we’ll dive deep into the 50-30-20 rule, breaking down its components and showing you how to implement it in your life for better financial stability.

Introduction

Money management can often be challenging, especially when it comes to making ends meet while also planning for the future. The 50-30-20 rule is a budgeting method designed to simplify this process by dividing your income into three distinct categories: needs, wants, and savings/debt repayment.

What is the 50-30-20 Rule?

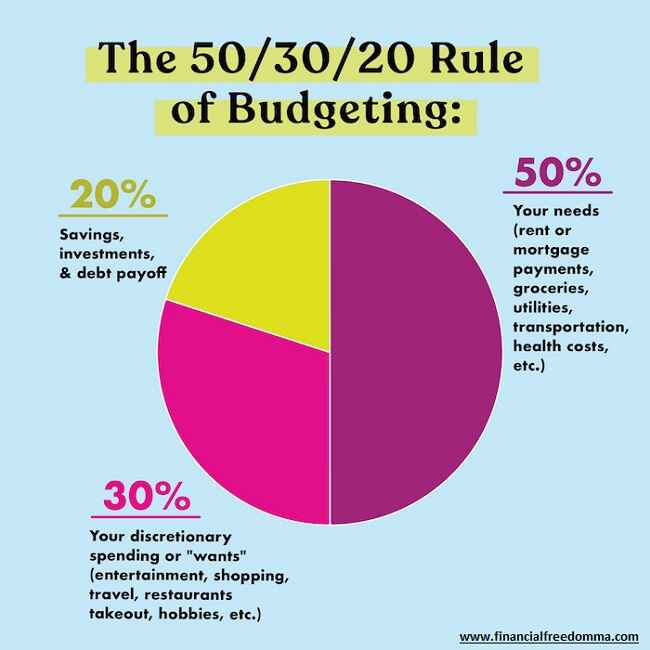

The 50-30-20 rule is a budgeting guideline that suggests allocating your after-tax income into specific spending categories. As the name suggests, this rule advocates for dividing your income into three main buckets: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Breaking Down the Three Categories

Needs (50% of Your Budget)

Your needs encompass essential expenses that are crucial for daily living. This category includes items like housing, utilities, groceries, transportation, and insurance payments. By ensuring that your needs fit within 50% of your budget, you create a solid foundation for your financial stability.

Wants (30% of Your Budget)

Wants are those expenses that improve your quality of life but aren’t absolutely necessary. This category covers entertainment, dining out, shopping for non-essential items, and hobbies. While it’s important to enjoy life, keeping wants within 30% of your budget prevents overspending.

Savings and Debt Repayment (20% of Your Budget)

The remaining 20% of your budget should be allocated to savings and debt repayment. This includes contributions to your emergency fund, retirement savings, and aggressively paying off high-interest debts. By prioritizing this category, you’re building a secure financial future for yourself.

Creating Your 50-30-20 Budget

Creating a 50-30-20 budget starts with calculating your after-tax income. Once you have that figure, divide it into the three categories as outlined in the rule. Tracking your expenses and making adjustments as needed will help you stay on track and achieve your financial goals.

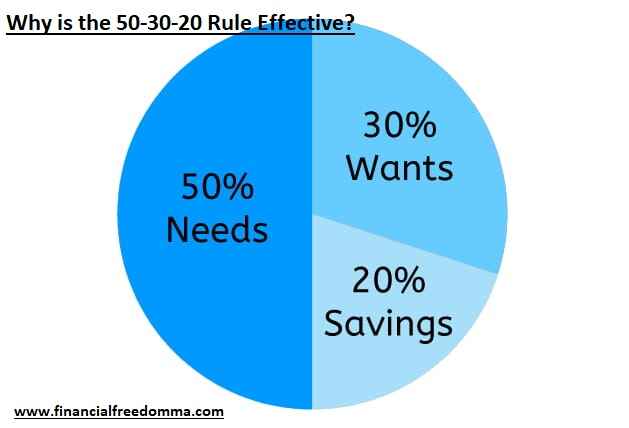

Why is the 50-30-20 Rule Effective?

The effectiveness of the 50-30-20 rule lies in its simplicity and flexibility. It provides a clear framework that’s easy to understand and implement, making it suitable for individuals of all financial backgrounds.

Benefits of Following the 50-30-20 Rule

Following the 50-30-20 rule offers numerous benefits, including better financial organization, reduced stress, improved savings habits, and a clearer path to achieving financial goals.

Tips for Successful Implementation

Track Your Expenses

To make the most of this budgeting technique, diligently track your expenses. This will help you identify areas where you might be overspending and allow you to make necessary adjustments.

Adjust as Necessary

Life is ever-changing, and your budget should adapt accordingly. If your circumstances change, don’t hesitate to adjust your budget percentages to reflect your new financial reality.

Prioritize High-Interest Debts

Allocating a portion of your budget to debt repayment, especially high-interest debts, can significantly improve your long-term financial health by reducing the amount of interest you pay over time.

Common Mistakes to Avoid

Neglecting Emergency Savings

Building an emergency fund is crucial. Failing to do so can leave you vulnerable to unexpected expenses and setbacks.

Ignoring Fluctuations

Certain expenses may fluctuate throughout the year. Be prepared to adjust your budget during months with higher expenses, such as holiday seasons.

Not Reassessing Periodically

Regularly reassess your budget to ensure it aligns with your financial goals and current situation. Your priorities may change, and your budget should reflect that.

Is the 50-30-20 Rule Right for Everyone?

While the 50-30-20 rule is effective for many, personal financial situations vary. Some individuals may need to modify the percentages to suit their circumstances, which is perfectly acceptable.

Alternative Approaches to Budgeting

If the 50-30-20 rule doesn’t resonate with you, there are various other budgeting methods available, such as the envelope system, zero-based budgeting, and the snowball method.

Long-Term Financial Goals

Adopting the 50-30-20 rule not only helps with short-term budgeting but also contributes to achieving long-term financial goals like building wealth, buying a home, or retiring comfortably.

Conclusion

In a world of financial complexities, the 50-30-20 rule offers a breath of fresh air. It simplifies budgeting, promotes financial discipline, and empowers individuals to take charge of their money. By allocating your income wisely and focusing on needs, wants, and savings, you’re setting yourself up for a more secure and prosperous future.

FAQs

Q1: Can I adjust the budget percentages according to my needs?

Ans: Absolutely! The 50-30-20 rule is a guideline; feel free to tailor it to fit your unique circumstances.

Q2: Is saving for retirement included in the savings category?

Ans: Yes, saving for retirement is an essential component of the savings category.

Q3: What if my income fluctuates each month?

Ans: If your income varies, aim to maintain the budget percentages on average. Adjustments can be made as needed.

Q4: Is there an easy way to track expenses for this budget?

Ans: Numerous budgeting apps are available that can simplify expense tracking and categorization